Sixfold

About Sixfold

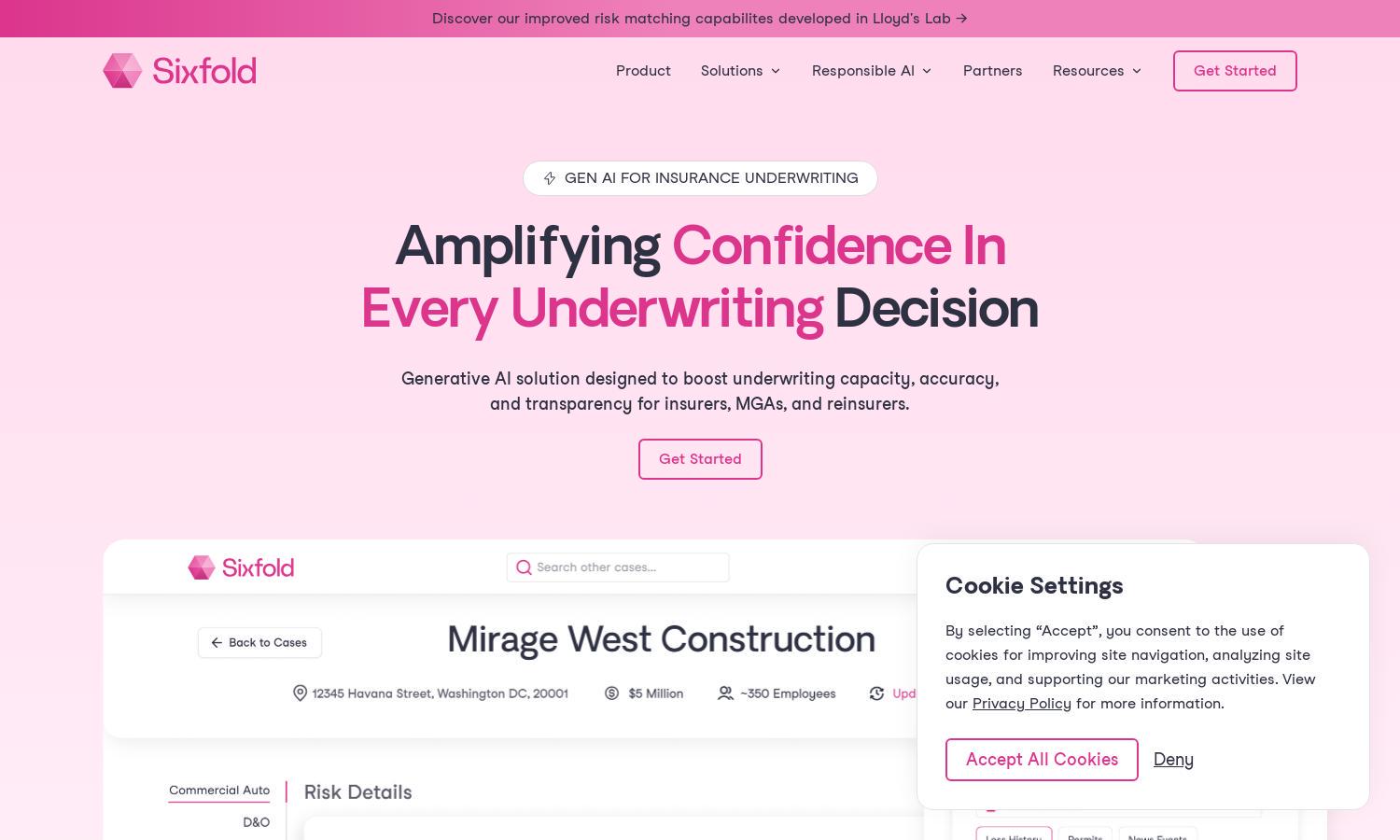

Sixfold revolutionizes the insurance underwriting process for professionals by leveraging generative AI technology. By ingesting existing guidelines and extracting relevant risk data, it provides customized recommendations enhancing decision-making efficiency. Users benefit from simplified risk analysis and full transparency, ensuring compliance within their underwriting efforts.

Sixfold offers flexible pricing plans designed for varying needs within the insurance sector. Each tier provides unique benefits, such as enhanced insights and compliance tools. Users upgrading to higher tiers enjoy advanced features that significantly optimize their underwriting processes, making Sixfold an invaluable asset for insurers.

The user interface of Sixfold is intuitively designed to facilitate a seamless experience for underwriters. With easy navigation and straightforward access to key features such as risk analysis and auto-suggestions, Sixfold enhances productivity and clarity, empowering users to focus on critical underwriting decisions.

How Sixfold works

Users begin by onboarding with Sixfold, which involves ingesting their underwriting manuals into the AI model. The platform then collects data from submissions and third-party sources, allowing for sophisticated analysis. As users navigate the interface, they receive tailored recommendations and insights, streamlining their underwriting processes while enhancing accuracy and compliance.

Key Features for Sixfold

Generative AI Co-Pilot

Sixfold's generative AI co-pilot uniquely empowers insurance underwriters by automating tedious tasks. This feature provides tailored, transparent risk insights, allowing users to focus on critical decision-making processes. By synthesizing complex data into actionable summaries, Sixfold enhances efficiency and accuracy in underwriting.

Risk Data Extraction

The risk data extraction feature of Sixfold significantly enhances underwriters' capabilities. By automatically collecting and analyzing supporting documents, this functionality ensures comprehensive risk assessments. It streamlines workflows and offers precise data insights, making Sixfold indispensable for underwriters looking to enhance their efficiency and decision-making.

Automatic Workflow Automation

Sixfold features automatic workflow automation, enabling underwriters to quickly identify risk signals and discrepancies. This streamlining of the underwriting process saves time and improves accuracy. By integrating seamlessly with existing systems, Sixfold empowers users to leverage AI capabilities without overhauling their tech infrastructure.

You may also like: